Blog

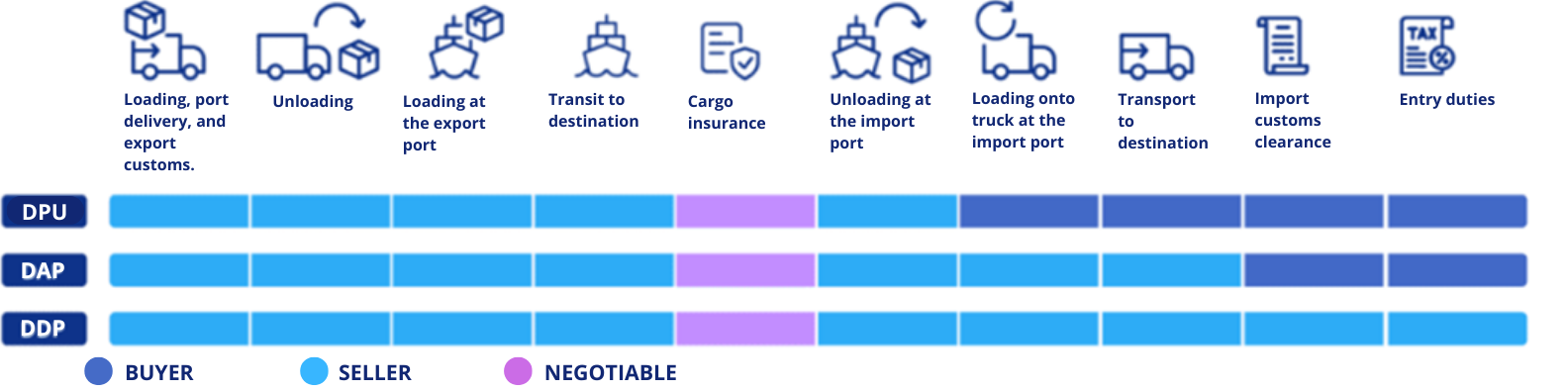

GROUP D: The seller becomes responsible for the costs and risks of transportation until the delivery of the goods at the designated place in the agreed destination country with the buyer.

DPU: Delivery at Place Unloaded

DAP: Delivery At Place

DDP: Delivery Duty Paid

INCOTERM DPU

In international trade, choosing the appropriate term to define the responsibilities between the seller and the buyer is crucial. One of these terms, INCOTERMS DPU (Delivery at Place Unloaded or "Entrega en Lugar Descargado" in Spanish), plays a fundamental role in facilitating global commercial transactions. Let's delve into what this term entails and its relevance in the realm of customs brokerage.

Understanding INCOTERMS DPU:

INCOTERMS DPU stipulates that the seller is responsible for delivering the goods to an agreed-upon place, unloaded from the transporting vehicle upon arrival at the destination. Here are some key aspects to consider:

Seller's Responsibilities:

The seller is responsible for delivering the goods at the agreed place, already unloaded from the means of transport upon reaching the destination.

Costs and Risks: Up to the point of delivery at the designated place, the seller assumes the costs and risks associated with the transportation of the goods.

Delivery and Unloading: The seller's responsibility includes delivering the goods unloaded at the agreed place, which involves coordinating transportation and unloading logistics.

Documentation: The seller is responsible for preparing and delivering the necessary documentation to allow the importation of the goods into the destination country.

Buyer's Responsibilities:

The buyer assumes key responsibilities once the goods are delivered at the designated place and unloaded from the means of transport. These responsibilities include:

Receiving the Goods: The buyer must ensure to receive the goods at the agreed place and verify that they are in conformity with the terms of the contract.

Unloading and Handling: Once the goods are unloaded, the buyer is responsible for their safe and proper handling, including storage and handling as necessary.

Customs Procedures: The buyer must handle the necessary customs procedures for importing the goods into the destination country, including submitting the required documentation and paying the corresponding duties and taxes.

Internal Transportation: Additionally, the buyer is responsible for arranging and covering the costs of internal transportation of the goods from the delivery place to their final destination, if applicable according to the terms of the contract.

Advantages of the DPU Term:

Flexibility in Delivery: DPU allows for greater flexibility by enabling the seller and the buyer to agree on a specific delivery place that can be any location convenient for both parties.

Clear Responsibilities: This term clearly establishes the responsibilities of the seller and the buyer in terms of delivery and unloading of the goods, which helps to avoid misunderstandings and conflicts.

Buyer Control: Once the goods are delivered and unloaded at the designated place, the buyer has greater control over the process, including handling and internal transportation.

Cost Reduction: By sharing the responsibility for delivery and unloading of the goods, DPU can help reduce costs for both parties by avoiding the need to hire additional handling and transportation services.

Disadvantages of the DPU Term:

Risks During Unloading: The buyer assumes the risks associated with unloading the goods at the designated place, which may raise concerns about damage or loss during this process.

Logistical Complexities: Coordinating the unloading and internal transportation of the goods can be complicated, especially if the delivery place is located in a remote or difficult-to-access area.

Additional Costs: The buyer must bear the costs associated with handling and internal transportation of the goods once they are delivered and unloaded at the designated place, which may increase the total transaction costs.

Increased Buyer Responsibility: DPU may require the buyer to have a higher level of expertise and resources to effectively manage the delivery and unloading of the goods, which may be challenging for some companies.

Legal and Logistical Considerations:

When working with Incoterms DPU, it is crucial to consider some legal and logistical aspects:

Delivery Place: It is essential to clearly specify the delivery place in the contract to avoid misunderstandings and ensure smooth delivery.

Documentation: The seller must provide all necessary documentation to allow the importation of the goods into the destination country, ensuring compliance with customs regulations.

Transport Insurance: Although not mandatory under Incoterms, the seller and the buyer may choose to insure the goods during transportation for added security.

Conclusion:

Incoterms DPU offers a clear framework for defining the responsibilities between the seller and the buyer in international trade, facilitating efficient and seamless delivery of goods. For customs brokerage companies, understanding this term is essential to provide quality service to their clients and ensure compliance with customs regulations at each stage of the importation process.

INCOTERM DAP

DAP: Delivery At Place - Delivery at Terminal

In the world of international trade, selecting the appropriate term to define the responsibilities between the seller and the buyer is essential for transaction success. One of these terms, Incoterms DAP (Delivery at Place or "Entrega en Lugar" in Spanish), plays a fundamental role in facilitating global trade. In this article, we will explore what Incoterms DAP entails and how it impacts customs brokerage operations.

Understanding INCOTERMS DAP:

INCOTERMS DAP establishes that the seller is responsible for delivering the goods at a designated place, ready to be unloaded by the buyer. Here are some key features:

Seller's Responsibilities:

The seller is responsible for delivering the goods at the agreed-upon place, ready for the buyer's unloading.

Costs and Risks: Up to the point of delivery at the designated place, the seller assumes the costs and risks associated with transporting the goods.

Delivery and Unloading: The seller must ensure that the goods are ready for unloading at the place designated by the buyer.

Documentation: The seller is responsible for providing the necessary documentation to enable the importation of the goods into the destination country.

Buyer's Responsibilities:

The Incoterm DPU, Delivery at Place Unloaded, clearly establishes the buyer's responsibilities once the goods have been delivered to the designated place and unloaded from the means of transport. Below, we explore the main responsibilities falling on the buyer under this term:

Receipt of Goods: The buyer is responsible for receiving the goods delivered at the agreed-upon place, ensuring that they comply with the terms of the contract and are free from damages or shortages.

Inspection and Acceptance: Upon receipt, the buyer must inspect the goods to verify their quality, quantity, and agreed-upon specifications. If there are any discrepancies, they must promptly communicate with the seller.

Unloading and Storage: It is the buyer's responsibility to coordinate and safely unload the goods at the designated place. Subsequently, they must store them appropriately and securely until they are processed for use or distribution.

Customs Procedures: The buyer assumes responsibility for completing all necessary customs procedures for the importation of the goods into the destination country, including the submission of required documentation and payment of corresponding duties and taxes.

Internal Transportation: Once the goods have been unloaded at the designated place, the buyer must arrange and cover the costs of necessary internal transportation to move them from the delivery location to their final destination.

Advantages of the DPU Term:

Flexibility in Delivery: DPU allows parties to agree on a delivery location that suits their business needs, providing flexibility in delivery logistics.

Clarity in Responsibilities: This term clearly establishes the seller's and buyer's responsibilities regarding the delivery and unloading of the goods, reducing the risk of misunderstandings.

Cost Reduction: By sharing the responsibility for delivery and unloading of the goods, DPU can help reduce costs for both parties by avoiding the need to hire additional handling and transportation services.

Increased Control: Once the goods are delivered and unloaded at the designated place, the buyer has greater control over the process, which can lead to increased efficiency in handling and internal transportation.

Disadvantages of the DPU Term:

Risks During Unloading: The buyer assumes the risks associated with unloading the goods at the designated place, which may raise concerns about damages or losses during this process.

Logistical Complexities: Coordinating the unloading and internal transportation of the goods can be complicated, especially if the delivery location is in a remote or challenging-to-access area.

Additional Costs: The buyer must bear the costs associated with handling and internal transportation of the goods once they are delivered and unloaded at the designated place, potentially increasing the total transaction costs.

Increased Responsibility: DPU may require the buyer to have a higher level of expertise and resources to effectively manage the delivery and unloading of the goods, which can be challenging for some businesses.

Legal and Logistical Considerations:

When working with Incoterms DPU, it is essential to consider some legal and logistical aspects:

Precise Delivery Location: Clearly specifying the delivery location in the contract is crucial to avoid misunderstandings and ensure seamless delivery.

Complete Documentation: The seller must provide all necessary documentation to enable the importation of the goods into the destination country, ensuring compliance with customs regulations.

Transport Insurance: Although not mandatory under Incoterms, the seller and the buyer may choose to insure the goods during transportation for added security.

Conclusion:

Incoterms DPU provides a clear framework for defining the responsibilities between the seller and the buyer in international trade, facilitating efficient and seamless delivery of goods. For customs brokerage companies, understanding this term is essential to provide quality service to their clients and ensure compliance with customs regulations at each stage of the importation process.

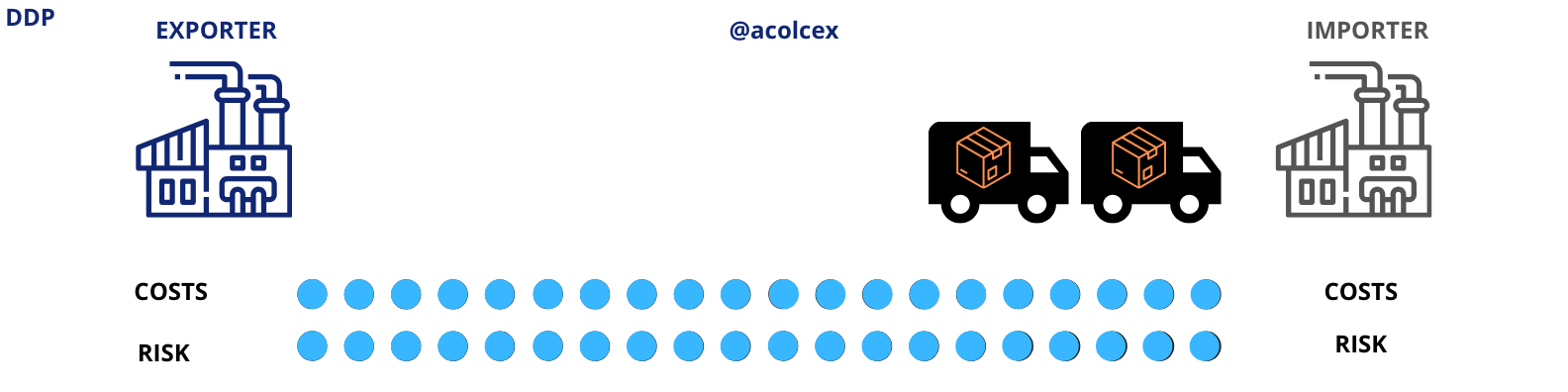

INCOTERM DDP:

In the complex world of international trade, selecting the right term to define responsibilities between the seller and the buyer is paramount to ensuring smooth and successful transactions. One of the most commonly used terms in this context is INCOTERM DDP (Delivery Duty Paid). In this article, we will explore what INCOTERM DDP entails and how it affects the operations of customs agencies.

Understanding INCOTERM DDP:

INCOTERM DDP establishes that the seller is responsible for delivering the goods at the agreed-upon place in the destination country, ready for unloading and free of import duties and other taxes. Here are some key characteristics:

Responsibilities of the seller under INCOTERM DDP:

The seller is responsible for arranging and paying for the transportation of the goods to the agreed-upon place in the destination country. They must complete all necessary export and transportation procedures to deliver the goods to the designated location.

Costs and risks: The seller assumes all costs and risks associated with transporting the goods to the destination, including import duties and other taxes.

Delivery and unloading: The seller must deliver the goods to the designated place in the destination country, ready for unloading by the buyer.

Customs procedures: The seller is responsible for completing all export and import customs procedures, including submitting the required documentation and paying the corresponding duties and taxes.

Buyer's Responsibilities under INCOTERM DDP

The INCOTERM DDP (Delivery Duty Paid) clearly defines the buyer's responsibilities once the goods have been delivered to the agreed-upon place in the destination country, ready for unloading and free of import duties and other taxes. Next, we explore the main responsibilities that fall on the buyer under this term:

Receipt of the goods: The buyer is responsible for receiving the goods delivered to the designated place in the destination country, ensuring that they comply with the terms of the contract and are free of damage or shortages.

Inspection and acceptance: Once the goods are received, the buyer must inspect them to verify their quality, quantity, and agreed-upon specifications. If there are any discrepancies, they should promptly communicate with the seller.

Internal transportation: After unloading the goods at the designated place, the buyer assumes responsibility for the internal transportation necessary to move them from the delivery location to their final destination.

Customs procedures: The buyer is responsible for completing all necessary customs procedures for importing the goods into the destination country, including submitting the required documentation and paying the corresponding duties and taxes.

Acceptance of delivery: Once the goods have been received and accepted at the designated place, the buyer must sign any necessary documents to confirm the delivery and acceptance of the goods.

Advantages of the DDP term:

Seller's responsibility: Under INCOTERM DDP, the seller assumes responsibility for delivering the goods to the designated place in the destination country, as well as paying import duties and other taxes. This can be beneficial for the buyer as they do not have to worry about these additional costs.

Simplicity for the buyer: By assuming responsibility for completing all necessary customs procedures, the seller can benefit from a simpler and more straightforward import process. This can save time and resources for the buyer, especially if they are not familiar with the customs procedures of the destination country.

Greater seller control: By being responsible for delivery and customs procedures, the seller has greater control over the transaction's logistics. This can ensure faster and more efficient delivery of the goods to the buyer.

Disadvantages of the DDP term:

Additional costs for the seller: Although INCOTERM DDP may offer benefits to the buyer, it can be costly for the seller. This is because the seller must pay import duties and other taxes in the destination country, which can increase the total transaction costs.

Logistical complexity: Coordinating delivery and completing customs procedures in the destination country can be complicated and time-consuming. This can pose logistical challenges for the seller, especially if they are not familiar with the customs requirements of the destination country.

Risk of documentation errors: Since the seller is responsible for completing all customs procedures, there is a risk of documentation errors occurring. This could delay the release of the goods at customs and affect the transaction's efficiency.

Legal and logistical considerations:

When working with INCOTERM DDP, it is important to consider some legal and logistical aspects:

Complete documentation: The seller must provide all necessary documentation to allow the import of the goods into the destination country, including export and import documents and commercial invoices.

Transport insurance: Although not mandatory under INCOTERMS, the seller and the buyer may choose to insure the goods during transportation for added security.

Conclusion:

INCOTERM DDP offers a clear structure for defining responsibilities between the seller and the buyer in international trade, facilitating smooth delivery of the goods and quick customs clearance. For customs agencies, understanding this term is essential to provide quality service to their clients and ensure compliance with customs regulations at every stage of the import process.