Blog

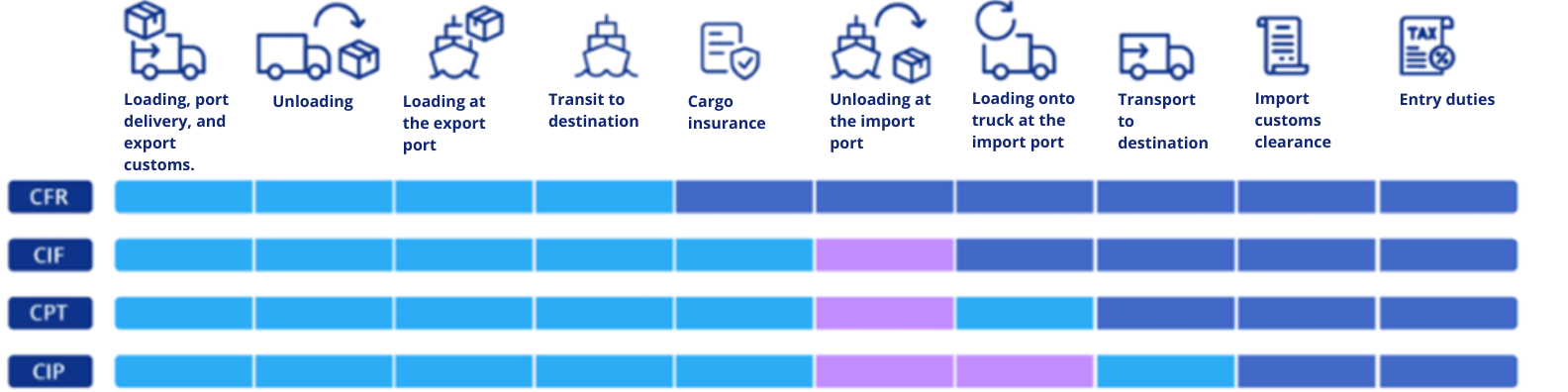

GROUP C: It refers to Indirect Delivery. In this case, the seller delivers the goods to an intermediary and is released from the risks of the operation. The place of delivery is determined and specified by the contract.

CFR: Cost and Freight

CIF: Cost, Insurance, and Freight

CPT: Carriage Paid To

CIP: Carriage and Insurance Paid To

![]()

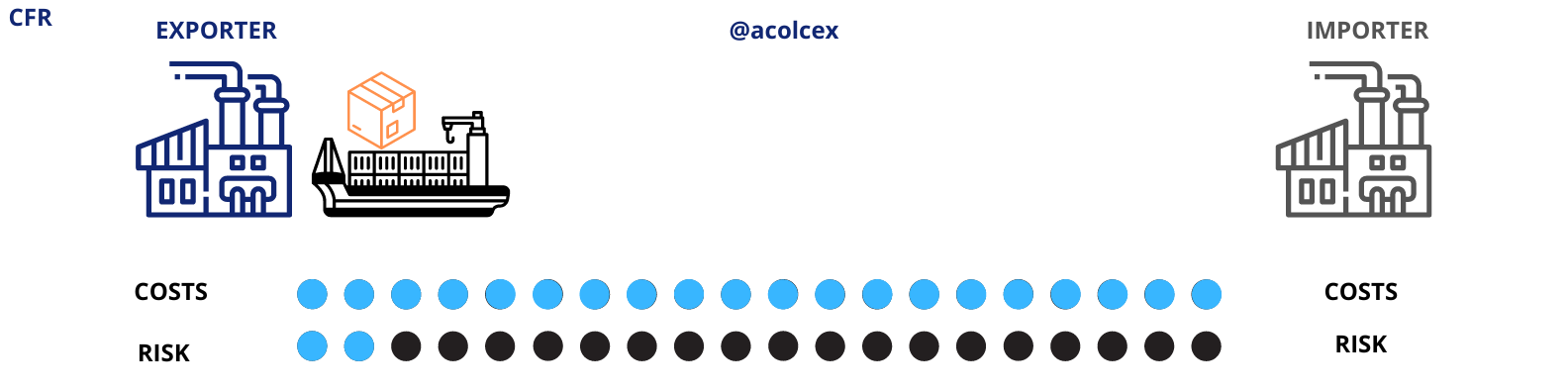

INCOTERM CFR

In International Trade, precise understanding of trade terms is crucial for the success of any business. One of the fundamental Incoterms that guides the dynamics between buyers and sellers is CFR, which stands for Cost and Freight. In this article, we will explore in detail what the term CFR entails and how it impacts customs brokerage operations.

What is the Incoterm CFR?

CFR: Cost and Freight

CFR establishes that the seller fulfills their delivery responsibility when the goods are placed on board the vessel at the designated port of shipment. From this point onward, the risk and costs transfer to the buyer. The term CFR is commonly used in maritime transactions and is essential for determining who assumes what responsibilities and expenses in the process.

Obligations of the seller under CFR:

Costs up to Port of Shipment: The seller assumes all costs and risks associated with bringing the goods to the port of shipment, including transportation and loading expenses.

Documentation: The seller provides the necessary documents for the buyer to obtain the goods at the destination port, such as the commercial invoice and bill of lading.

Risks: Although all responsibility lies with the seller, the buyer assumes the related risks. Once the products reach the first port, the risk transfers to the importer.

Insurance: There is no obligation to purchase insurance; however, if the buyer desires it, the risk and costs remain theirs.

Obligations of the buyer under CFR:

Costs from Port of Shipment: The buyer assumes costs and risks from the moment the goods are on board the vessel. This includes maritime freight costs, insurance, and any other expenses related to international transportation.

Customs Clearance in the Destination Country: The buyer is responsible for customs procedures in the destination country, including customs clearance and payment of local duties and taxes.

The Importance of Customs Brokerage in CFR Transactions: For companies specialized in customs brokerage, understanding CFR is essential. It facilitates efficient collaboration between sellers, buyers, and customs agents to ensure a smooth import process in compliance with local regulations.

Risks: The transfer of risk occurs once the seller loads the goods at the port of departure. Throughout the journey and until its final destination, all risks are assumed by the buyer.

Taxes and customs clearance: All costs related to importation fall on the buyer. Once the goods are left at the port, the buyer is responsible for covering import fees and taxes, as well as any other charges at the local level.

Advantages:

Simplicity in negotiation: CFR offers a clear structure for responsibilities and costs, facilitating negotiation between the seller and the buyer. This can be beneficial, especially in simpler commercial transactions.

Freight Costs: The seller bears the costs and risks associated with transportation to the port of shipment. This gives the buyer greater control over maritime freight costs, as the seller is responsible for arranging and paying for transportation to the port.

Documentation: CFR clearly defines the required documentation, such as the commercial invoice and bill of lading. This establishes standards and facilitates the preparation and processing of documents, which can streamline customs clearance.

Disadvantages:

Risks during maritime transport: Although the seller bears the costs up to the port of shipment, the buyer assumes the risks from that point onward. Any damage or loss during maritime transport becomes the buyer's responsibility.

Complexity in local customs clearance: CFR implies that the buyer is responsible for customs clearance in the destination country. Depending on the complexity of local customs procedures, this could pose challenges and require specialized assistance.

Limited control over logistics: Although the buyer has control over maritime freight, they may have limited control over other logistical and transportation aspects, such as the choice of shipping line or cargo consolidation.

Potential disputes over damages: Since the seller's responsibility ends when the goods are on board, any damage that occurs during the loading process may lead to disputes over responsibility.

Change in freight costs: Freight costs may fluctuate, and if the contract does not clearly specify how these changes will be handled, there could be challenges in managing variations in transportation costs.

Legal considerations:

Risk transfer: CFR establishes that the risk of loss or damage to the goods transfers from the seller to the buyer when the goods cross the ship's rail at the port of shipment. It is crucial to clearly define in the contract how risks and claims will be managed in case of loss or damage during maritime transport.

Cargo insurance: Although CFR does not require the seller to provide cargo insurance, it is advisable for the buyer to consider insuring the goods during maritime transport to cover potential losses or damages. Insurance conditions should be clearly defined in the contract.

In conclusion

CFR is a key term that outlines responsibilities and costs in international maritime transactions. Collaboration among all parties involved, supported by an experienced customs broker, ensures successful navigation through the challenges of international trade under this Incoterm.

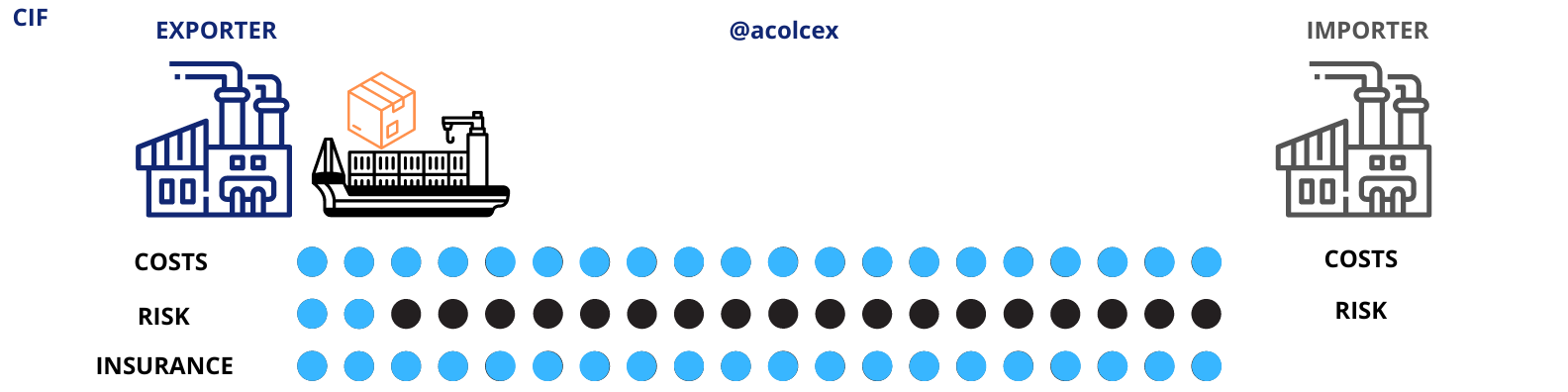

INCOTERM CIF

The world of international trade is filled with specific terms that define responsibilities and costs between buyers and sellers. One of the fundamental Incoterms is CIF, which stands for Cost, Insurance, and Freight. In this article, we will explore in detail the CIF term and its relevance in the realm of customs brokerage.

What is it?

CIF: Cost, Insurance, and Freight

CIF is an agreement between buyer and seller that clearly establishes the obligations and costs associated with the transportation of goods from the place of origin to the agreed-upon destination port. Here are key aspects to consider:

Seller's obligations:

Delivery at the port of shipment: The seller is responsible for delivering the goods on board the vessel at the designated port of shipment. This involves costs associated with loading the goods onto the vessel.

Costs up to the port of shipment: The seller assumes the costs and risks associated with transporting the goods to the port of shipment, including transportation and loading expenses.

Transport insurance: The seller must provide transport insurance covering the risk of loss or damage to the goods during maritime transport to the destination port.

Documentation: The seller must prepare and deliver the necessary documentation for the buyer to collect the goods at the destination port:

- Bill of Lading (as well as the Ocean Bill of Lading)

- Commercial invoice

- Insurance certificate

- Packing list

- Import license

Risks: The transfer of risks from the seller to the buyer occurs once the goods are loaded onto the vessel.

Taxes and customs clearance: All requirements and costs for customs clearance in terms of exportation must be carried out by the seller.

Buyer's obligations:

Costs from the port of shipment: The buyer assumes the costs and risks from the moment the goods are on board the vessel. This includes maritime freight costs, insurance, and any other expenses related to international transportation.

Customs clearance at the destination country: The buyer is responsible for customs procedures in the destination country, including customs clearance and payment of local duties and taxes.

Risks: The transfer of risk occurs when the seller loads the goods onto the vessel. Throughout the journey and until their final destination, all risks are assumed by the buyer, even though the goods are already insured.

Advantages:

Simplicity in negotiation: CIF offers a clear structure for the allocation of costs and responsibilities between the seller and the buyer. This simplifies negotiation and understanding of each party's obligations.

Seller's responsibility in transportation: The seller takes responsibility for delivering the goods on board the vessel and arranging transportation to the destination port. This relieves the buyer of initial logistical complexities.

Inclusion of transport insurance: CIF includes the cost of transport insurance, providing an additional layer of protection for the goods during the journey. The seller manages the insurance, which can be convenient for the buyer.

Ease in receiving goods: The buyer receives the goods at the destination port, simplifying the reception process. The seller arranges transportation to that point, facilitating operations for the buyer.

Disadvantages:

Buyer's risks after shipment: Although the seller is responsible for transportation and insurance up to the destination port, the buyer assumes the risks from that point onward. Any issues during maritime transport can pose challenges for the buyer.

Limitation in choice of carriers: The seller has control over the choice of the shipping line and other logistical details. This could limit the buyer's flexibility in selecting carriers and routes.

Challenges in local customs clearance: The buyer is responsible for customs clearance at the destination country. Depending on the complexity of local customs procedures, this could result in challenges and additional costs for the buyer.

Potential disputes over damages: Since the seller's responsibility ends when the goods are on board, any damage that occurs during the loading process may lead to disputes over liability.

Hidden costs in insurance: Although transport insurance is included in CIF, buyers must be vigilant about insurance details. There may be limitations or exclusions that result in unforeseen additional costs.

Legal considerations:

Transfer of risks: CIF clearly establishes when risks are transferred from the seller to the buyer. The goods are insured during transportation, and any loss or damage that occurs before delivery at the destination port is the seller's responsibility. However, after delivery at the port, risks are assumed by the buyer.

Assessment of additional costs: CIF involves additional costs such as maritime insurance. Both parties must fully understand these costs and how they will be distributed. Possible additional costs associated with delivery delays or itinerary changes should also be considered.

Importance of customs brokerage in CIF transactions:

For companies specializing in customs brokerage, understanding CIF is crucial. It facilitates efficient collaboration between sellers, buyers, and customs agents to ensure a smooth import process and compliance with local regulations.

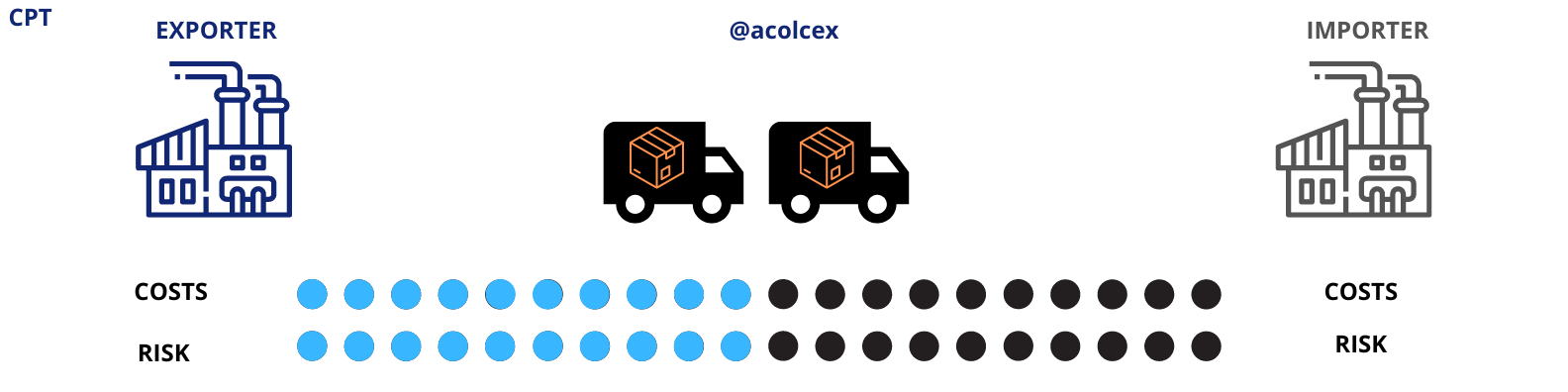

INCOTERM CPT

In the exciting world of international trade, understanding the terms that govern transactions is crucial to ensuring smooth and efficient operations. One of these terms, Incoterms CPT (Carriage Paid To), plays a fundamental role in negotiating and executing commercial contracts. In this article, we will delve into Incoterms CPT and its relevance, especially from the perspective of customs brokerage.

What is it?

CPT: Carriage Paid To

Incoterms CPT defines the responsibilities and costs associated with the transportation of goods from the place of origin to a designated destination. Here are key aspects to consider:

Seller's obligations:

Delivery of goods: The seller is responsible for delivering the goods to the carrier or any other person nominated to carry out transportation at the agreed place.

Costs up to the point of destination: The seller bears the costs and risks associated with transporting the goods to the specified destination in the contract. This includes freight charges and other related costs.

Transport insurance: The seller must provide transport insurance covering at least the risk of loss or damage to the goods during transportation.

Documentation: The seller is responsible for preparing and providing the necessary documentation for the buyer to take delivery of the goods at the destination. This may include the commercial invoice, bill of lading, and other relevant documents.

Risks: The seller bears all risks until the point agreed upon by both parties, after which they are transferred to the importer. Loading and unloading procedures can be negotiated in advance between both parties.

Customs: Customs clearance for export is included in the terms of CPT as a seller's responsibility. Whether the delivery point is in their own country or the buyer's, they must handle documentation, carry out, and cover the process.

Freight terms: Freight will be the responsibility of the exporter up to the specified destination, regardless of the chosen mode of transport. Once it reaches this point, whether at the port of their country or the buyer's, responsibilities are transferred.

Buyer's obligations:

Receipt of goods: The buyer assumes responsibility for receiving the goods at the agreed destination.

Customs clearance in the destination country: The buyer is responsible for carrying out customs procedures and paying applicable duties and taxes in the destination country.

Costs after unloading: From the moment of unloading, the buyer assumes the costs and risks associated with the goods.

Risks: The transfer of risks occurs once the goods reach the destination specified by the seller and buyer, and the products are reloaded onto the new carrier.

Insurance: Acquiring insurance is not mandatory. If the buyer decides to do so, they may purchase one at their own risk, and the seller will not incur any costs.

Advantages:

Simplicity in negotiation: Incoterms CPT simplifies negotiation by clearly establishing who is responsible for costs and risks at each stage of transportation.

Seller's responsibility in transportation: The seller is responsible for transportation to the agreed destination, relieving the buyer of initial logistical complexities.

Transport insurance: The seller provides transport insurance, offering an additional layer of protection for the goods during their journey.

Disadvantages:

Risks for the buyer after unloading: Once the goods are unloaded at the destination, the buyer assumes the risks, which can pose challenges if problems arise at this stage.

Limitation in choice of carriers: The seller has control over the choice of carrier, which could limit the buyer's flexibility.

Challenges in local customs clearance: The buyer is responsible for customs clearance in the destination country, which could result in challenges and additional costs.

Legal aspects to consider:

Transfer of risks: Incoterms CPT clearly establishes when risks are transferred from the seller to the buyer, so understanding this point is essential to avoid misunderstandings.

Customs responsibilities: Clear allocation of customs responsibilities must be specified in the contract to ensure proper legal compliance.

Importance of Incoterms CPT in customs brokerage:

In summary, Incoterms CPT is a term that provides clarity and efficiency in international transactions. Its proper understanding, supported by experts in customs brokerage, is essential for smooth international trade. Incorporate it wisely into your contracts to navigate successfully in the ocean of global commerce.

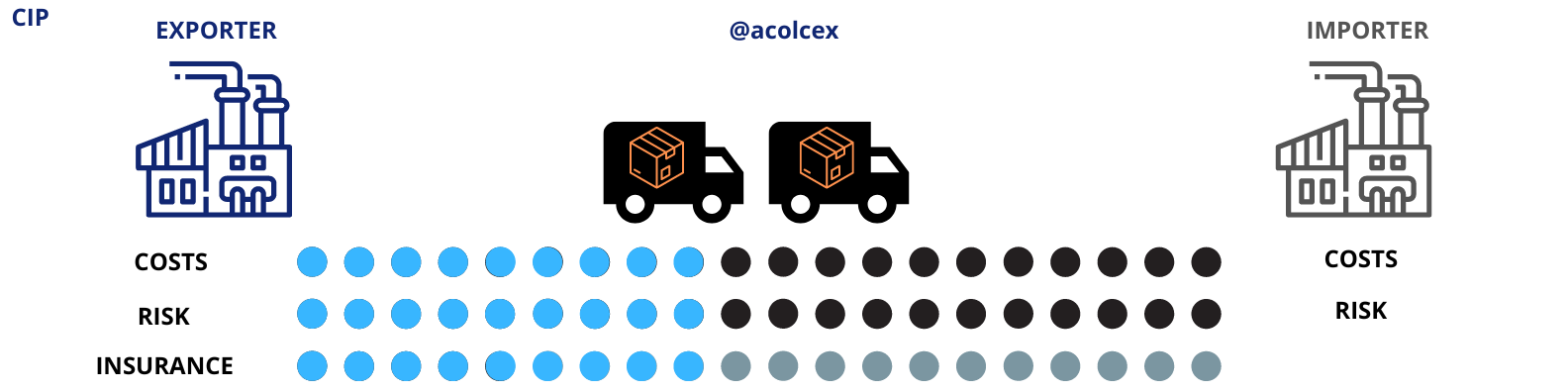

INCOTERM CIP

In the dynamic world of international trade, understanding the terms governing transactions is essential for business success. One of these terms, Incoterms CIP (Carriage and Insurance Paid To), plays a crucial role in facilitating global commerce. In this article, we will delve into Incoterms CIP and its relevance, especially from the perspective of customs brokerage.

What is Incoterms CIP?

CIP: Carriage and Insurance Paid To

Incoterms CIP establishes the responsibilities and costs associated with the transportation of goods from the place of origin to a designated destination, including the cost of insurance. Here are key aspects to consider:

Seller's obligations under Incoterms CIP:

Delivery of goods: The seller is responsible for delivering the goods to the carrier or any other person nominated to carry out transportation at the agreed place.

Costs and risks to the point of destination: The seller assumes the costs and risks associated with transporting the goods to the specified destination in the contract, including the cost of insurance.

Transportation insurance: The seller must provide transportation insurance covering at least the risk of loss or damage to the goods during transportation.

Documentation: The seller is responsible for preparing and delivering the necessary documentation for the buyer to take delivery of the goods at the destination. This may include the commercial invoice, bill of lading, and other relevant documents.

Buyer's obligations under Incoterms CIP:

Receipt of goods: The buyer assumes the responsibility for receiving the goods at the agreed destination.

Customs clearance in the destination country: The buyer is responsible for completing customs procedures and paying applicable duties and taxes in the destination country.

Costs of unloading: From the moment of unloading, the buyer assumes the costs and risks associated with the goods.

Advantages:

Insurance: A key advantage of Incoterms CIP is the inclusion of transportation insurance, providing an additional layer of protection for the goods during transit.

Control: The seller has greater control over transportation and insurance, facilitating more effective logistical planning.

Simplicity in negotiation: It clearly establishes responsibilities and costs, simplifying negotiation and reducing potential misunderstandings.

Disadvantages:

Risks for the buyer after unloading: After unloading at the destination, the buyer assumes the risks, which can pose challenges if issues arise at this stage.

Limitation in choice of insurance and carrier: Although it provides insurance, the seller chooses the insurance and carrier, limiting the flexibility of the buyer.

Complexities in customs clearance: The buyer is responsible for customs clearance in the destination country, which could result in challenges and additional costs.

Legal considerations:

Details of insurance coverage: Thoroughly review the insurance coverage provided by the seller to ensure adequate protection and compliance with legal requirements.

Proper documentation: Correct preparation and presentation of documentation are essential to comply with customs regulations and other legal requirements.

Detailed agreement on destination: Clarity about the destination in the contract is essential to avoid misunderstandings and ensure smooth execution.

Additional considerations:

Detailed insurance coverage: It is crucial to thoroughly review the insurance coverage provided by the seller to ensure adequate protection for the goods.

Agreement on the destination: Clarity about the destination is essential to avoid misunderstandings and ensure smooth execution.

Proper documentation: Correct preparation and presentation of documentation are fundamental to comply with customs regulations and other regulatory requirements.

Importance of Incoterms CIP in customs brokerage:

For customs brokerage companies, Incoterms CIP provides a clear framework for understanding the parties' obligations and facilitates coordination of customs procedures in the destination country. The inclusion of insurance in the contract is particularly relevant as it offers an additional layer of protection for the goods during transit.

In summary, Incoterms CIP is a valuable tool that provides clarity and efficiency in international transactions, particularly regarding transportation and insurance. Its proper application, supported by experts in customs brokerage, is essential for smooth international trade. Incorporate it wisely into your contracts to navigate successfully in the global trade ocean.